Money & the World

2023: The Year of FOMM (Fear of Making Money)

Stocks have boomed this year. Yet many DIY investors have sprinted from markets — and missed out on big returns. What spooked them?

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

This story first ran in TLDR, Wealthsimple’s weekly non-boring newsletter.

If you can remember anything about January of this year, it’s probably that everything felt bad. Interest rates were up. Recession alarm bells were blaring. Succession was ending soon. And pros like Mike Wilson, Morgan Stanley’s chief investment officer, were going around predicting that the stock market might drop another 20% in 2023. And that was after the S&P 500 and TSX had just nosedived by 19% and 8.5%, respectively, in 2022. The economic situation felt so grim that Wall Street’s yearly outlook, as tracked by Bloomberg, was the bleakest it had been in almost a quarter of a century. Investors felt more chipper after the dot-com bust, 9/11, and the ’08 financial crisis.

The backdrop to all this sourness was that the markets had just endured a dizzying few years. Between mid-February and late March 2020, the S&P 500 spiralled down by more than 30% as COVID swept the world. And on the heels of this downturn followed a frothy, stimulus-fuelled rally (remember the $GME frenzy?) that sent the S&P up by more than 100% by November 2021. Was the whiplash over? Of course not. That rally met an abrupt, painful end in late 2021, when central bankers vowed to raise economy-slowing interest rates to control soaring inflation. Which a lot of folks assumed would crush the economy.

But that, to the shock of many, isn’t what happened. Yes, stocks fell sharply in 2022, costing individual traders some US$350 billion. But as interest rates rose in 2023, the labour market held strong. Corporate earnings came in far better than anticipated. AI sparked tons of optimism about the future. And, most important and surprising of all, inflation fell sharply without the economy skidding into a recession. At least, it hasn’t yet.

Investors didn’t have FOMO, or fear of missing out. They feared, so they missed out.

As the economic sky cleared, institutional investors, ecstatic with relief, plowed money back into markets, pushing up stocks globally by about 13% since January 1st of this year and kicking off a new rally. The tech-heavy Nasdaq has soared by an even more impressive 32%. (The light-on-tech TSX, up by only 4% YTD, is something of an outlier.)

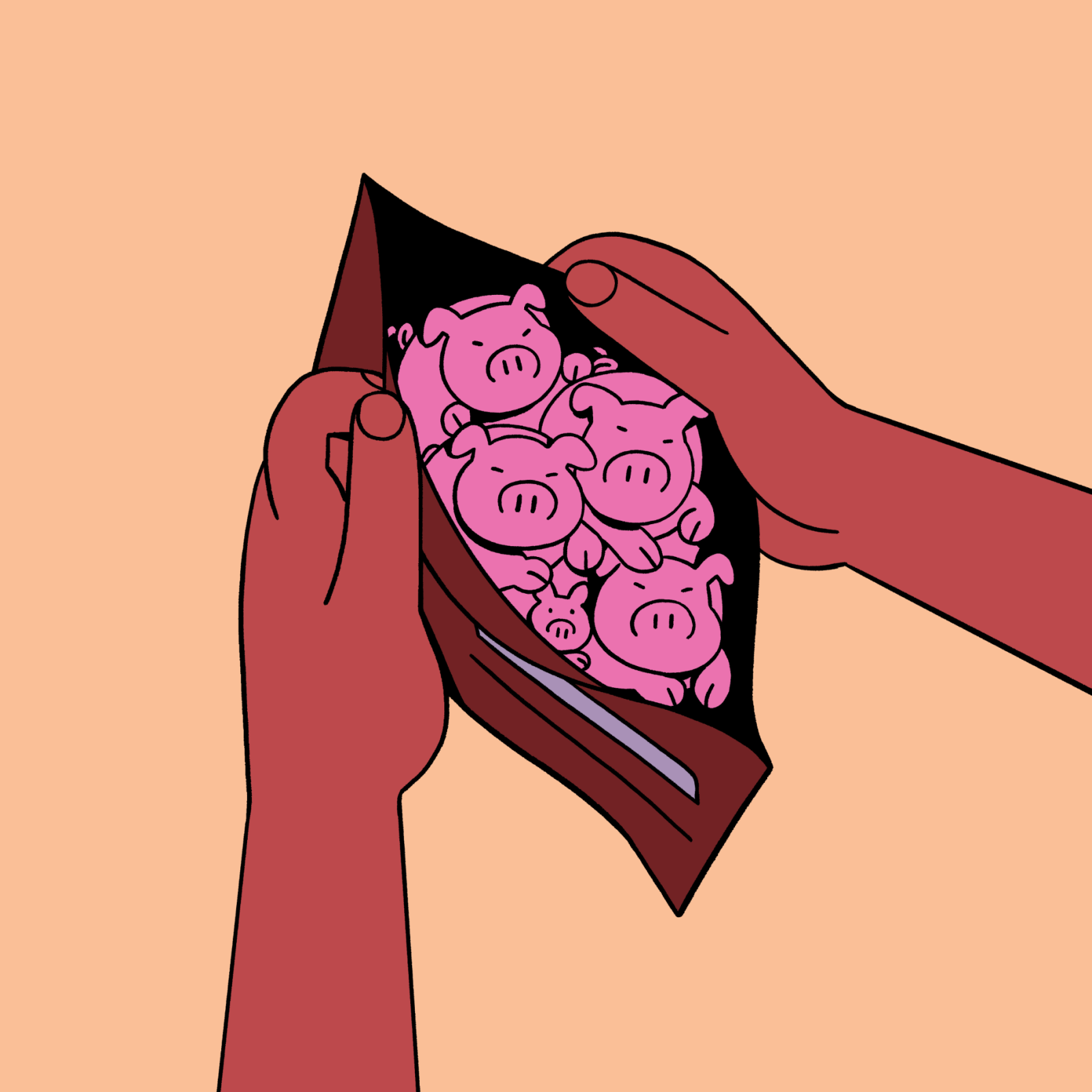

But, as pros piled into stocks, many individual investors — average folks like you and me — refused to uncover their eyes and see that things looked … good. DIY trading activity was anemic throughout the spring and early summer. These so-called retail investors didn’t have FOMO, or fear of missing out. They feared, so they missed out.

So: why? Why did DIY investors sit out the rally? Bad vibes. That’s the most obvious answer. This rally just feels different, especially compared to the frothy one of 2021. And inflation bears most of the blame. Millennials and Gen Xers had heard Boomers talk about how terrible those ’70s price spikes were. But hearing about inflation and experiencing it are different things. We learned that it’s hard to feel optimistic about anything, really, if your paycheque isn’t keeping up with rising prices or if rate hikes might force you to sell your home.

Amplifying people’s discomfort, the economy had just gone through a huge adjustment, with millions of people being fired and rehired during COVID. Bad vibes on top of bad vibes. The next shoe was going to drop at any moment. You could feel it. So people stopped investing. According to IFIC data, Canadians bought $7 billion in mutual funds from January through May of last year. But, over the same period this year, they sold $9 billion worth of mutual funds — a $16 billion swing.

Here’s the wrinkle in the story: the reasons why DIY investors missed or were late to the spring rally were novel, but that they failed to capitalize on it was not. Retail traders, spooked by brisk declines in their portfolios, often sell off their assets at the bottom of the market and remain on the sidelines as stocks climb back up. They did that very thing in 2001, 2008, and 2020. And it cost them. The S&P 500 has tended to fall by 41% during bear markets, according to a recent paper, while it has typically risen by 162% during bull markets. Which helps to explain why families tend to lose more money panic selling during downturns than if they’d stayed invested: they often delay reinvesting and miss rallies.

So, if you’re wondering: OK, what now? Is the rally running out of juice, or is it just getting started? No one knows. No one ever knows. That’s sort of the point of this entire essay. Inflation surprised investors this year. Next time, it’ll be something else. To avoid making a costly blunder, successful long-term investors — Warren Buffett being the most famous among them — advise staying in the market and steadily investing through good times and terrible ones. Because boring, steady, diversified investing usually wins in the end. This year only reinforced the point: stay the course when bad vibes abound — and they will abound sooner or later — and don’t look away when other investors avert their eyes.

Jared Sullivan is an editor for Wealthsimple Magazine. He’s also writing a book for Knopf about the Kingston coal-ash disaster.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.