Money & the World

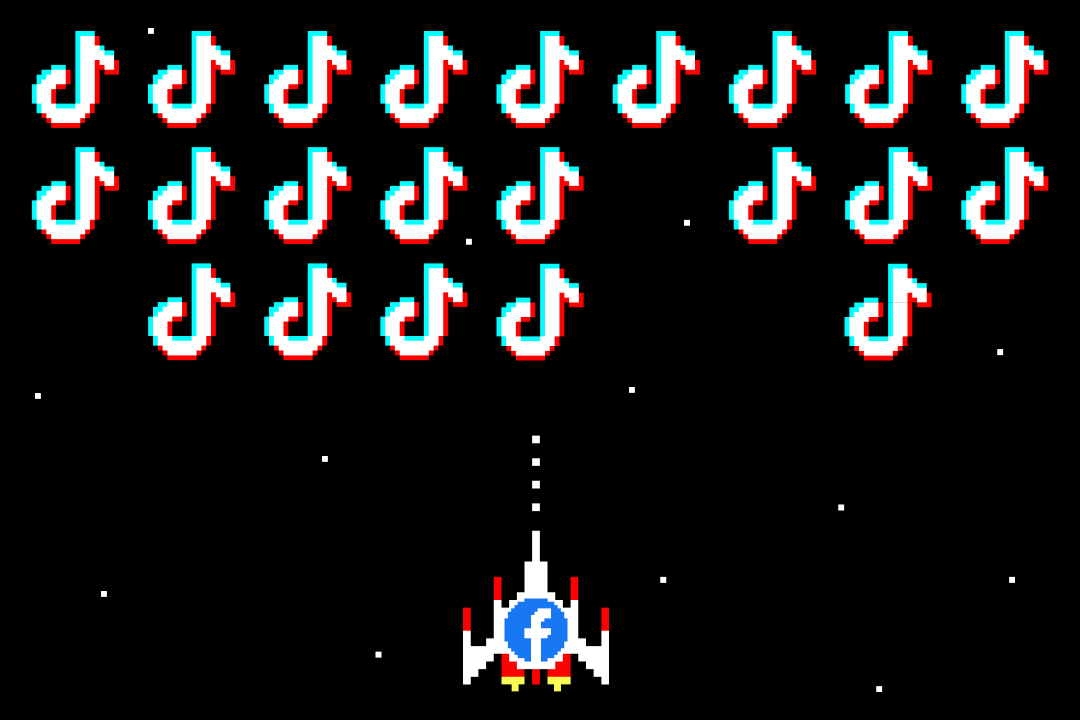

In the War Against TikTok, Zuck Has Algorithm Envy

The Chinese-owned video platform is growing fast and gobbling up tens of billions of dollars of ad revenue each year. Legacy social-media brands, in turn, are fighting for eyeballs, and survival.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Note: This story first ran in TLDR, Wealthsimple’s weekly, non-boring newsletter about money, markets, and crypto.

Fresh Pew data out this month reconfirmed the number one fear of Silicon Valley’s social-media giants: TikTok is in juggernaut mode, with kids or teens in one study averaging 91 minutes a day on the platform, compared to 56 minutes on YouTube, its closest eyeball-holding competitor. The Chinese-owned viral-video platform reached one billion monthly active users faster than either Facebook or Instagram and is on track to triple its revenue this year to US$12 billion. This “unprecedented level of competition,” in Mark Zuckerberg’s words, has left platforms of old scrambling to slow TikTok and retain their bites of the US$223ish-billion global social-media apple. Here’s how legacy social media (did we just call it that?) is trying to stop TikTok.

Shameless cribbing

The biggest way ye olde platforms are trying to regain footing is by introducing their own TikTok-esque features. Facebook and Instagram now have “Reels.” YouTube has “Shorts.” Even Netflix has something called “Fast Laughs” in the U.S. And the platforms’ algorithms are now prioritizing what a former Facebook VP called random “America’s Funniest Home Videos” -style content — aka TikTok’s stock-in-trade. This marks a huge shift in strategy. (More on that in a moment.)

Throw money at makers

The better the content, the stronger your position. Hence YouTube created a US$100-million fund to pay creators for exclusive content (that is, videos they don’t cross-post on TikTok), with monthly bonuses of up to $10,000. Meta pays similar $4,000 bonuses. Which is still a lot better than the “almost nothing” TikTok doles out, especially to Canadians.

Lobbying and legacy media

Meta has zero room to criticize other companies’ business questionable practices, but it has nonetheless capitalized on the national-security concerns over TikTok’s Chinese ownership (not to mention how it can now allegedly track your keystrokes) by paying to have negative stories about it placed in newspapers (you know, the things Meta obliterated 15 years ago).

THE UPSHOT

Meta, YouTube, et al. have had little luck slowing down TikTok, in large part because it rewrote the rules of the entire social-media game, as noted social-media geek Matt Navarra recently explained to TLDR. Legacy social platforms gained prominence by sourcing content from users’ friends or family, whereas TikTok is now winning with an unbeatable algorithm that delivers videos that are super addictive regardless of their origin. It’s viral choreographed dance routines versus photos of your cousins’ kids. Which is no contest.

Social feeds are becoming less personal as a result. And that, Navarra says, is driving users elsewhere and threatening all social-media platforms. Because, get this: Gen Z, for all its TikTok love, is the sole age group whose social-media use fell last year, as users migrated to private chat apps, like Discord. The social-media era isn’t over. But Apple, for one, is betting that the chat-app trend will continue in a big way, as privacy concerns mount over TikTok specifically and social media generally. Apple, which already kneecapped social platforms by limiting app tracking on the iPhone, reportedly intends to enhance iMessenger with new social-media-like qualities (presumably not the icky ones), giving poor, poor Mark Zuckerberg one more empire-threatening competitor to fret about.

Sarah Rieger is a news writer for Wealthsimple Magazine. She was previously a staff writer and editor at CBC News and HuffPost Canada. You can reach her at srieger@wealthsimple.com, or on Twitter at @sarahcrgr.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.