Money & the World

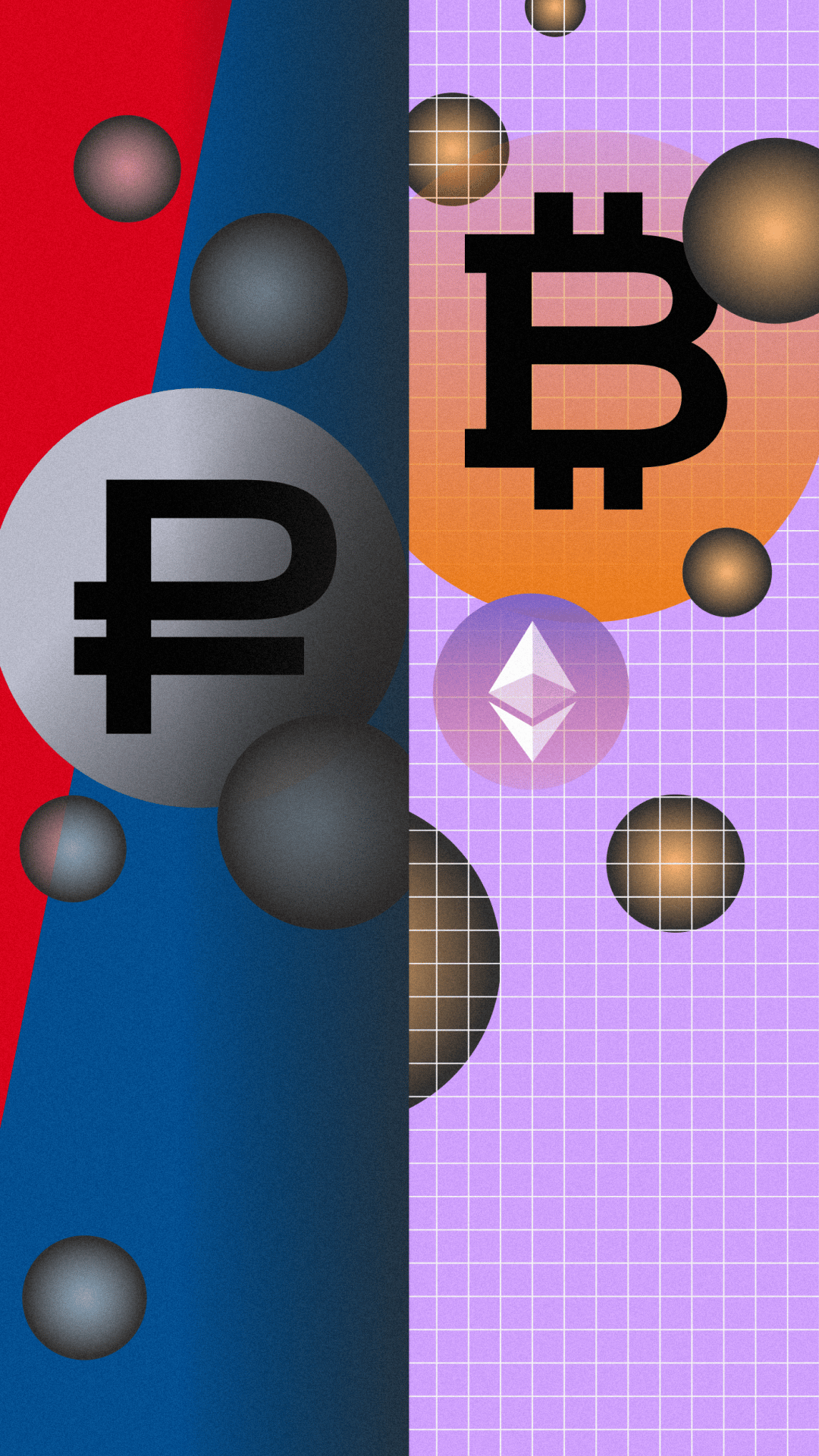

How the Brutal War in Ukraine Could Also Change Crypto

With the Russian economy in free fall, cryptocurrencies have become — and this is something we’ve never typed — monetary safe-havens, expanding the potential of decentralized financial systems.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Among its many unexpected consequences, Russia’s invasion of Ukraine has been something of a shock to markets, creating what Wall Street folks call “economic uncertainty.” Which is a rather antiseptic way of saying that there’s been enormous, unpredictable, and sometimes strange financial turmoil, and no one is exactly sure how it’ll all shake out. Stocks are sliding. Commodity prices are surging. The Russian ruble is in the basement. (More on that in a moment.) And in the foreground, of course, is the enormous human suffering throughout Ukraine.

What’s happening geopolitically is not, of course, about financial markets or crypto. But the fallout has, for observers, been an unexpected test case for the benefits (and dangers) of crypto. Prices and trading volumes have surged, and DeFi advocates think this moment could be a crypto tipping point in the world’s financial system. “[The ongoing conflict in Ukraine] will probably go down in history as a catalyst for innovation and potentially perspective change,” Henry Kim, a professor at York University’s Schulich School of Business, who specializes in blockchain, explained to Wealthsimple Magazine. But it’s an open question what a possible “perspective change” could look like, both good and bad.

Russia’s Economy Reeled After It Was Hammered With Sanctions

First, some context: the Russian economy is, by just about every measure, in free fall. Since late last week, Canada, the U.S., and EU nations have hit Russia with a raft of increasingly tough economic sanctions. Over the weekend the EU announced that it would ban transactions with Russia’s central bank, isolating Moscow’s economy and limiting its ability to finance the war against Ukraine. As a result, the value of the Russian ruble has fallen about 30%. The Russian central bank responded by doubling interest rates — in an effort to stabilize its currency — and closing the nation’s stock market. Suffice it to say, it’s never a sign of stability when a country decides to close its stock markets.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

Those Conditions Drove Up Crypto Prices

As the Russian economy veered into uncertain financial territory this week, the total value of bitcoin overtook that of the Russian ruble for the first time in history. Cryptocurrencies, bitcoin in particular, have had some very, shall we say, tough recent months. Stocks have also been hurting: the S&P 500 and other major American stock indices are approaching corrections territory (aka a 10% drop). BTC, though, has risen about 20% in the last week. Why? As the ruble has plummeted, a lot of Russians, as well as Ukrainians, have rushed to swap their rubles, or Ukrainian hryvnias, for bitcoin or purported stablecoins like tether, before the value of the money in their bank accounts sheds even more value. Trading volumes between those Russian and Ukrainian fiat currencies and crypto have nearly tripled from pre-invasion levels, according to market data firm Kaiko. (Caveat: there is some debate about the extent to which these currency swaps are actually happening.) The Ukrainian government and NGOs supporting it have also increased crypto trading volume; the Ukrainian government listed its wallet address on its official Twitter account, and it (and NGOs supporting the country’s military) subsequently raised more than $54 million USD through cryptocurrency donations.

We Are Witnessing a Use Case for Crypto. But Also for Traditional Money, Too

Crypto proponents have long maintained that digital currencies, given their decentralized nature, are resistant to censorship due to their pseudonymity. It’s a big selling point — it means that crypto could potentially enable greater economic mobility for people at risk of persecution by the governments, for one. But decentralized finance also poses a potential issue for central governments, since imposing sanctions and tracking illegal money trails is much easier when governments control monetary systems. That said…

Neither the Russian Government nor Oligarchs Are Using Crypto to Massively Skirt Sanctions

According to the blockchain surveillance company Chainalysis, ordinary citizens, not the Putin regime or Russian oligarchs, seem to be driving most of the crypto trading volume in Russia, as folks try to convert rubles to bitcoin. That doesn’t mean Russian elites haven’t carried out some transactions over the past few months, as Putin’s forces prepared to attack Ukraine. But if they tried to convert a lot of cash to crypto right now, says Kim, of York University, they probably wouldn’t get far. Big currency moves would get noticed, given the transparent nature of blockchain. And for that reason, crypto is “not necessarily going to be that concerning” in terms of sanctions evasion, a deputy U.S. Treasury secretary told Politico this week. Moreover, to bypass sanctions, the Russian state or Russian oligarchs would need trading partners willing to risk tons of penalties to do business with them, and no crypto exchange is volunteering, at least as far as is known.

Recommended for you

Prediction Markets Are, Suddenly, Everywhere. Wall Street Wants In

Money & the World

The Long-Term Economic Disaster of Cash Bail

Money & the World

What’s Up With All Those Crypto Laser-Eyes Profile Pics? A Definitive Investigation

Money & the World

We Discovered the True Identity of the NFT Artist “Pak”

Money & the World

Sanctions Enforcement Depends A lot on Where Exchanges Are Located

On Monday, the White House asked crypto exchanges to stop certain Russian organizations and individuals (i.e., oligarchs) from using their services. Ukraine’s vice prime minister made a similar plea, asking exchanges to block the addresses of all Russian users. Many crypto exchanges were Not. Into. It. The world’s largest exchange, Binance, refused to freeze the assets of Russian or Belarusian users, saying that doing so would go against the entire reason for cryptocurrency. A Binance spokesperson said in an email to Wealthsimple Magazine that the company will take aggressive actions only against officially sanctioned users. Jesse Powell, CEO of Kraken, another exchange, had a similar reaction, writing in a Twitter thread, “If we were going to voluntarily freeze financial accounts of residents of countries unjustly attacking and provoking violence around the world, step one would be to freeze all U.S. accounts,” adding, “As a practical matter, that’s not really a viable business option for us.”

Canada’s government requires that exchanges that offer services in the country honour its laws (which includes sanctions), and to report any large or suspicious transactions to the Financial Transactions and Reports Analysis Centre of Canada. (Wealthsimple Magazine contacted Canada’s Department of Finance to ask if it plans to make a similar request of cryptocurrency exchanges as the White House did, but we’ve yet to receive a response.)

Ensuring that exchanges actually follow the law and sanctions gets tricky, however, with global organizations, like Binance, which has been pretty opaque about where it’s headquartered. Countries like Canada and the U.S. could rely on enforcement partners abroad, but nations will also likely have to rely on global exchanges’ voluntary compliance, at least for now. And if you’re anything like us, you’re probably thinking: If the past decade has taught us anything, it’s that trusting huge tech companies to regulate their users, or themselves, doesn’t always work! Which, fair point. But also, if global exchanges don’t honour sanctions, they risk really ticking off the world’s most powerful governments and facing all the not-fun consequences that come with that. So exchanges, for all their hard talk of kissing no ring, are incentivized to play ball, as much as they might downplay that fact. (FWIW Wealthsimple, the company that owns this magazine, has a regulated crypto exchange in Canada.)

Ok, So Where Does That Leave Us?

This is complicated stuff! A big question that’s been batted around online is whether all the Russian money pouring into crypto will lead to new, unexpected regulations of digital currencies. The answer, says Kim, is no — mostly since more crypto regulations were already on the way before war broke out. And many major players in the crypto space want these regulations anyway, he says, since regulation often leads to greater legitimacy.

Still, bad actors will, almost without a doubt, continue to look for sanctions loopholes, and crypto could play a role, large or small, in helping them earn or conceal wealth. Heavily sanctioned Iran currently brings in an estimated one billion dollars USD a year through bitcoin mining, as a way to skirt Western sanctions. If Russia — which already mines about 11% of bitcoin globally each year — lands in a similar position of never-ending sanctions, it could use some of its massive oil and gas supply to power computers to mine crypto. This isn’t a wild, far-fetched possibility: in early February, the Russian government made a sharp about-face, from wanting to ban crypto mining to striking an agreement to recognize crypto as currency.

Perhaps a more likely scenario, though, is everyday Russians increasingly relying on crypto to diversify their assets and to prevent lashing the fate of their wealth to the fate of the ruble. There’s precedent for this: in Venezuela, some businesses have swapped out bolivars for BTC in an attempt to beat the country’s hyperinflation. More meaningfully, perhaps, crypto could provide some semblance of monetary security for innocent people caught in the middle of conflict, like the Ukrainians, who can put their money in digital coins as their nation struggles to resist tyranny and as many of them flee to neighbouring countries. Ukraine’s decentralized fundraising efforts, the scale of which hasn’t really been seen before, have illuminated another value of crypto in times of crisis; it’s impossible to imagine a traditional banking system allowing so much money from around the world to flow into a war-torn nation as quickly as it has this week. Cryptocurrencies are still inherently volatile. And it’s always prudent to exercise heaps of caution when speculating about them, and doubly so when a volatile political situation gets thrown into the mix. “If anyone tells you they think they know how bitcoin’s going to behave,” Kim says, “I think they’re lying or they have too much hubris.”

Sarah Rieger is a senior news writer for Wealthsimple Media, and co-host of the TLDR podcast. She was previously a reporter at CBC News and editor at HuffPost Canada. You can reach her at srieger@wealthsimple.com.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.