Money & the World

End Times for Tech Stocks?

OK, OK: tech stocks aren’t dying. But there’s a case to be made that rising interest rates could end their decade-plus-long dominance, which has everyone wondering: what comes next?

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Over the past three months, tech stocks have mounted a massive turnaround. After shedding a third of its value last year, the tech-heavy Nasdaq is up 17% since January 1. Which might lead you to think that the story of the first quarter is that tech is once again triumphant. Maybe! But legendary investor Steve Eisman, of The Big Short fame, sees a different narrative; he believes a brand-new financial era is on the horizon. “Sometimes [paradigms] change violently,” he told Bloomberg recently, “and sometimes those paradigms change over time because people don’t give up their paradigms easily. And I think we’re going through a period possibly like that again.”

The paradigm Eisman was referring to is the one that began after the 2008 financial crisis, when central banks cut interest rates to zero and kept them there, kicking off the frothy, free-money era that helped tech stocks — $AAPL, $GOOGL, $META, etc. — lead the market for more than a decade. Now investors like Eisman hold that higher borrowing costs could end that era. And he might have a point.

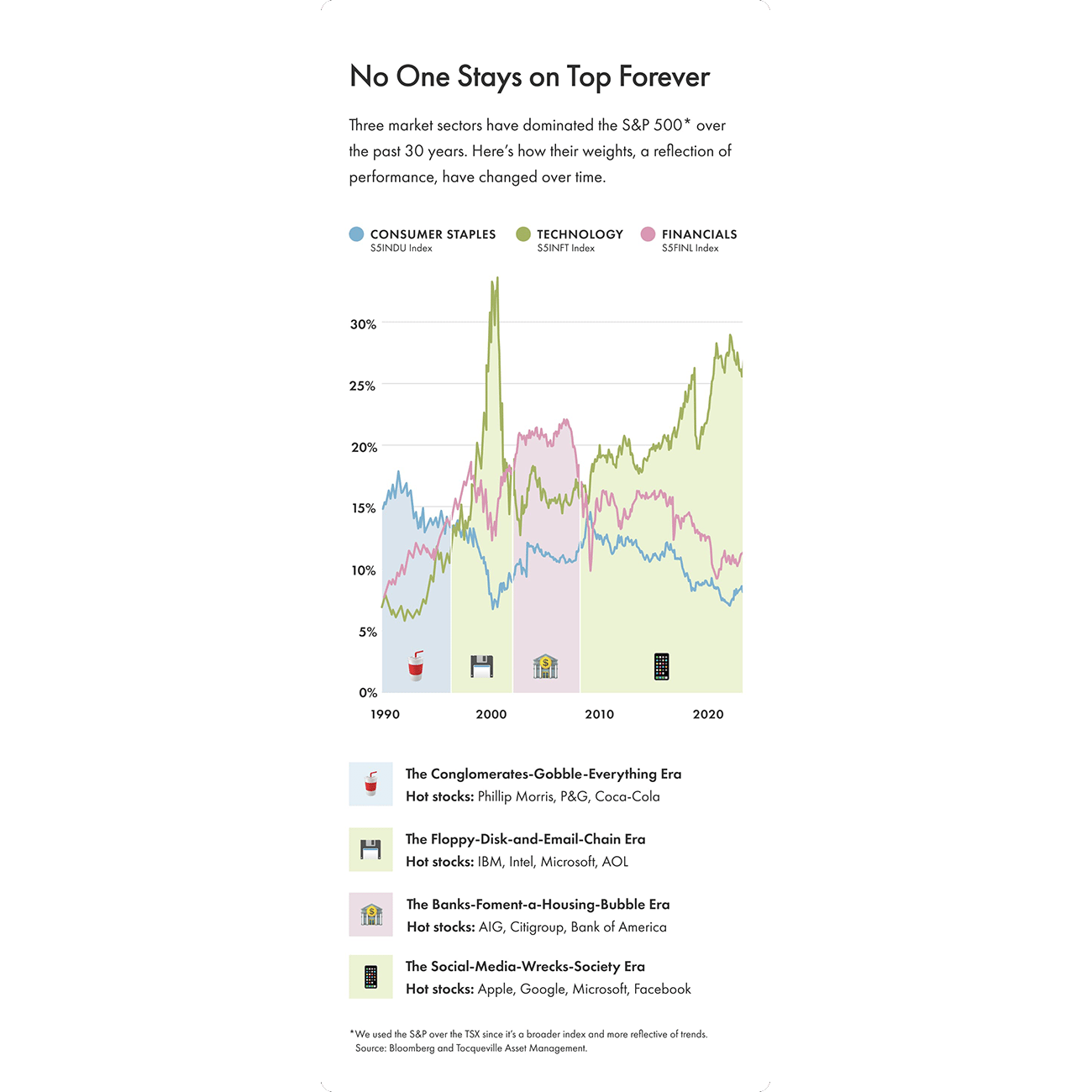

Markets Are Overdue for a Shakeup

There tends to be a major financial shift about once a decade as market dynamics change. In the ’70s, it was inflation that caused an upheaval. In the ’80s, rate hikes and deflation. In the ’90s, a small recession followed by rate cuts. These shifts have always upended whichever companies dominate the stock market. (See the chart below.) Among the ten most valuable companies in the world by market cap in 2000, a grand total of two — Walmart and Microsoft — remained in that rarified air 10 years later. And only Microsoft remained in the top ten from 2010 to 2020.

The frothy era that’s perhaps behind us now was driven by a leap-forward in tech (e.g., the iPhone) and by historically low interest rates. And these rates gave investors little reason to keep cash in the bank, which drove money into higher-risk, higher-growth bets, like tech. Last year’s rate hikes changed this dynamic, and triggered the tech-stock meltdown. Though the sector has rallied, Eisman argues that if interest rates stay high, as policymakers have promised they will, the era of tech supremacy is likely over, because investors will begin to favour companies that spit out a lot of cash now rather than ones, like tech firms, that promise windfalls far in the future.

So What’s Next?

It’s hard, if not impossible, to accurately predict which assets will perform well after a paradigm shift. If we assume Eisman is right about tech stocks fading, one candidate might be commodities, which did well during the high-inflation ’70s. Another contender: consumer staples (food, alcohol, etc.), a perennial safe haven. Or the shift could be geographic. American stocks command 60% of the value of all stocks globally, and no surprise: U.S. stocks surged 400% over the past 15 years. But replicating such a performance would be an extremely tall order. American stocks are currently near their most expensive levels, relative to earnings, in history. But it isn’t clear which country or countries, if any, might usurp the U.S.

Why Timing Is Tough

The other problem with paradigm shifts is timing. Does the fact that the Nasdaq has surged in 2023 mean Eisman is wrong about tech stocks, or just early? It’s hard to know! Central bankers could cut rates if the economy teeters, which would help tech stocks retain their #1 spot and make 2022 just a blip in their continued dominance. On the other hand, regime changes take time. As Eisman pointed out to Bloomberg, after the 2008 crisis, bank stocks soared in 2009 and 2010 before falling again; they haven’t led the market since. Something similar could be happening now: the tech party is over and the lights are on, but investors, eyes-closed, just want to keep dancing, damn it. But they can’t keep it up forever, at least not if rates stay high.

Complicating the timing issue further, most market shifts play out fairly slowly — and much more slowly than the one we endured during Covid. It took only a year and nine months to hit the top of the work-from-home bull market after the March 2020 crash. This slower cycle means we might not know which companies will lead the market for some time. What is clear is that the investors who succeed will, as ever, be the ones who can adapt. Steve Eisman got rich betting against the U.S. housing market, but he told Bloomberg he’s not making that same trade again. The paradigm has changed.

Philip Grant is the associate publisher of Grant’s Interest Rate Observer, a financial newsletter that, among its many distinctions, was one of the first publications to warn about the 2008 financial crisis.