Money & the World

Is Netflix Still a Growth Stock Now? And Other Streaming Wars Questions Answered

Matthew Belloni of Puck explains why some video-subscription services are struggling, why analysts bear some of the blame, and what it all means for the future of what you watch.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

The streaming wars are getting bloody. As you’re probably aware by now, Netflix lost 200,000 subscribers over three months and expects to lose 2 million (!) more in Q2. Yikes. The very-not-great news drove Netflix stock to fall by a painful 36% in a single day. The company blamed the subscriber loss on, well, sort of everything: competition, the war in Ukraine, password sharing. Cable-news network CNN, meanwhile, shut down its new streaming app, CNN+, a mere month after launch. Then there’s YouTube, whose quarterly ad revenue fell short of expectations this week. For the time being, at least, there’s one victor: HBO Max added 3 million viewers last quarter, and it’s positioned to gain more, with its content library set to balloon as it merges with Discovery+. But HBO’s subscriber boost was a rare bright spot in an industry facing increasingly tough questions from investors about subscriber churn.

We talked to Matthew Belloni, a founding partner of Puck — a new entertainment, finance, and politics outlet — and a former editor for The Hollywood Reporter, about what’s next in streaming.

SR: Netflix hasn’t been doing so good, to put it mildly — and hot takes abound about how the company reached this point. What are people getting wrong about the situation?

MB: I don’t think Netflix has reached a panic situation quite yet. It’s still a very strong business, with more streaming subscribers than any other platform. That’s great. The problem is that Wall Street does not believe Netflix is a billion-subscriber business anymore. To grow, the company needs to fundamentally change the calculus of how it adds subscribers. And that’s going to be difficult.

This is a company, after all, that has always resisted advertising; now they’re going to have ad-supported plans. This is a company that hasn’t cared about password sharing; now they’ll need to crack down. And this is a company that has poured billions and billions of dollars into producing a firehose of content; now they’ll need to be more disciplined. Altogether this adds up to a real shift in strategy. But I don’t think Netflix is in danger of going out of business, or of being usurped anytime soon by a competitor.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

In a piece for Puck, you wrote that Wall Street bears some blame for Netflix’s current predicament — by driving up its share price and touting it as a key disruptor, when analysts should have known that the economics of streaming could not match that of cable TV. Now things have changed. So what happens next?

What’s next for Netflix and other streaming platforms is refocusing on how to grow subscribers and revenue. And the revenue aspect here is important because you can’t invest in just growth. Not anymore. These companies need to make money. That’s behind everything Netflix is now doing. If the company can successfully crack down on password sharing, for instance, they might see major revenue spikes. But if a crackdown drives a lot of people to cancel, then they’ll have to reevaluate things and explore other paths forward — like more pricing increases such as the recent ones in the U.S. and Canada. They’ll also need to figure out what to charge for an ad-supported tier.

Let’s talk about the streaming ecosystem broadly. What are some challenges these companies are facing?

Content is very expensive, and you have to have a lot of it exclusively on your service to attract customers. It’s not like the old days of cable television, where you offer a bundle of channels supported by subscriber fees. With streaming, you have to justify your existence every day. And it’s very easy for users to cancel, unlike with cable. So the money spent on streaming is going to deliver a lower rate of return, unless you can generate, and retain, hundreds of millions of subscribers. And that’s what Wall Street thought the streaming companies would do — that, within five years, they would have 300, 400, or 500 million subscribers, then the economics would look fabulous. But that thinking is changing. [Netflix currently has roughly 221.6 million subscribers; Amazon Prime Video has around 200 million.]

If you can’t reach those crazy high viewership numbers by charging people for premium video, then how do you get to them? That’s what everybody is trying to figure out.

Recommended for you

What’s Up With All Those Crypto Laser-Eyes Profile Pics? A Definitive Investigation

Money & the World

How 2023 Cracked Wall Street’s Crystal Ball

Money & the World

How to Consume and Discern Information in Our Slop-Infested World

Money & the World

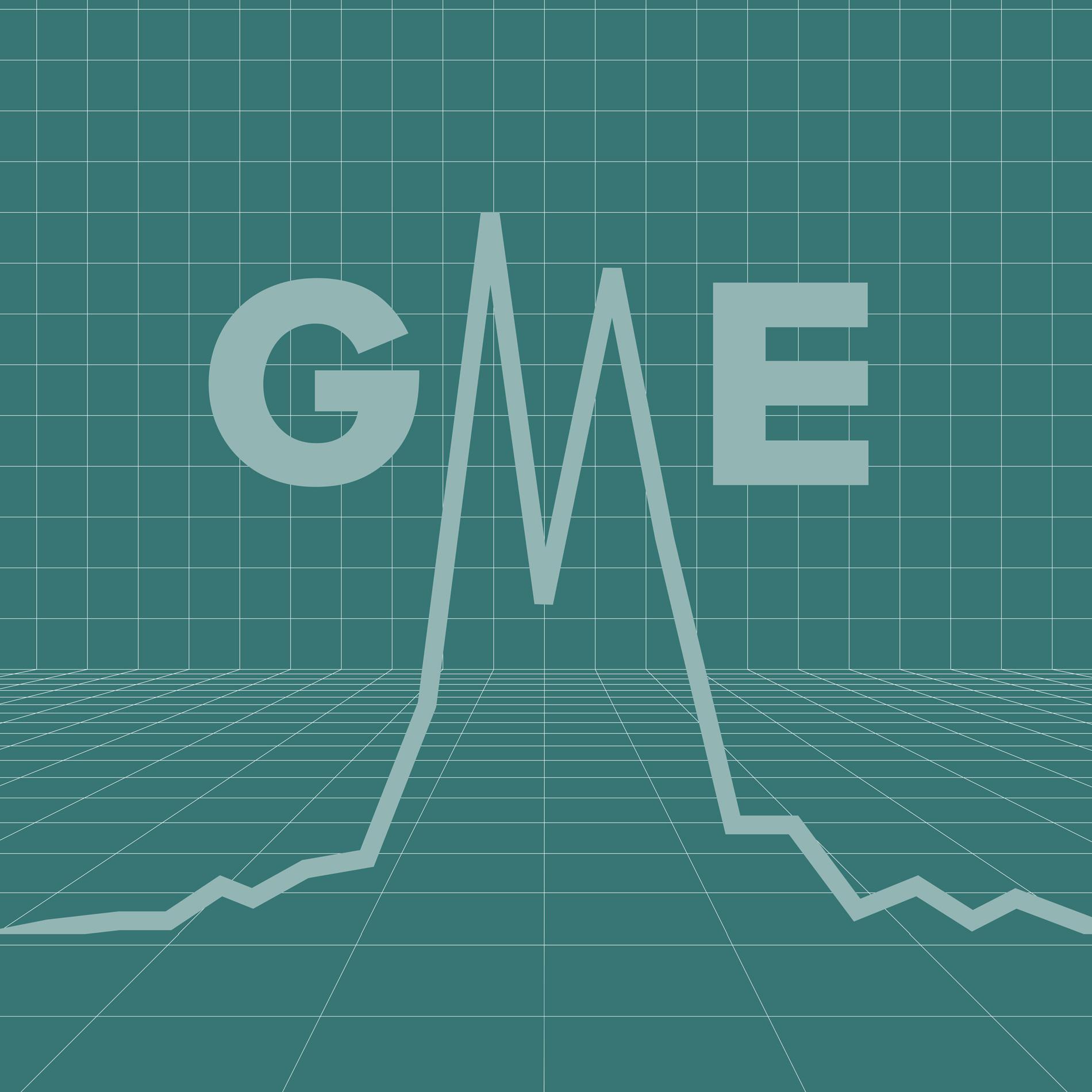

Data: Who Really Traded GME? Why? And What Happened to Them?

Money & the World

So Netflix is the big loser of the moment, or so it seems anyway. Is there a company that is quietly winning the streaming wars? What strategies are actually working?

Well, I think that the traditional media companies are actually pretty well-positioned at this point, because they have diversified businesses. They release movies in theatres, they have linear television networks, they have theme parks, etc. As a result, most legacy brands have a diversified revenue stream, and with this revenue, they can afford to support their streaming transition. I actually think that the legacy companies that investors long ago wrote off for not being as savvy as Netflix are actually in the best position.

Netflix has been criticized for putting out a lot of low-brow shlock, and for cancelling cult favourites after a couple of seasons in favour of content that its data suggests will perform better. Are other platforms going in this same algorithmically driven direction? And if so, are we going to see tons of junk shows and less quote-unquote better content?

You know, better is such a subjective word. I think that one innovation Netflix has popularized is looking very closely at highly specified data to determine what’s working and what’s not. And that data informs decisions about the shows and movies it green lights. That doesn’t mean a Netflix show will be better or worse than other stuff; it doesn’t even mean that a show will ultimately be popular. Because this is a creative business, and you can put all the pieces together to make a great film or series— and it can still be garbage. But Netflix tries to make informed decisions. And the other companies are catching up to that.

On a recent podcast, your guest Jason Kilar, CEO of WarnerMedia (owner of HBO Max), predicted Netflix would soon have ads — now an ad-supported tier is on the way. So I’m going to ask you to prognosticate a little here: What’s next for streaming services? Are they going to become network cable again?

I think we’re going to see consolidation, with services combining either through mergers or through subscriber bundles. There’s going to be a realization, I think, that the average customer isn’t willing to subscribe to more than four or five streaming services at the most. So having seven, eight, nine, ten of these products is really challenging from a business perspective. A way around this is to go niche and be a service that doesn’t appeal to a mass global audience. [Shudder is a horror-and-thriller streaming service.] But, if that’s the case, you have to decrease your content spend, because you can’t spend like you’re a global service with only a niche audience. Unless you’re Apple. Apple can do whatever it wants because it makes trillions of dollars elsewhere.

Read Belloni’s recent piece at puck.news: “Netflix’s Post-Crash Identity Crisis”

This interview was edited for concision and clarity.

_______________________________________________________________

Wealthsimple Favourites

A computer language that controls the financial world.

Nine tips for surviving tax season.

What’s up with all those crypto laser-eye profile pics?

The true thoughts of worried stock-photo traders.

EmRata on capitalism and commodifying her body.

Why the stock market goes up over time.

Raising middle-class kids when you’re no longer middle class.

Sarah Rieger is a senior news writer for Wealthsimple Media, and co-host of the TLDR podcast. She was previously a reporter at CBC News and editor at HuffPost Canada. You can reach her at srieger@wealthsimple.com.