FOR ADVISORS

Give your clients a better way to do group savings

Grow your revenue and improve retention by giving your clients the retirement and savings solution they’ll thank you for.

More than your average savings plan

Smart admin tools

Turn months of work into days for you and your clients, thanks to streamlined onboarding, easy plan management, and zero paperwork.

The provider employees already love

With 53% of new plan members already using Wealthsimple, most of the heavy lifting to earn your clients’ trust is already done.

Unique plan benefits

From one of Canada’s first Group FHSAs, to unique milestone rewards for plan members, we’re always adding more benefits.

A win for you and your clients

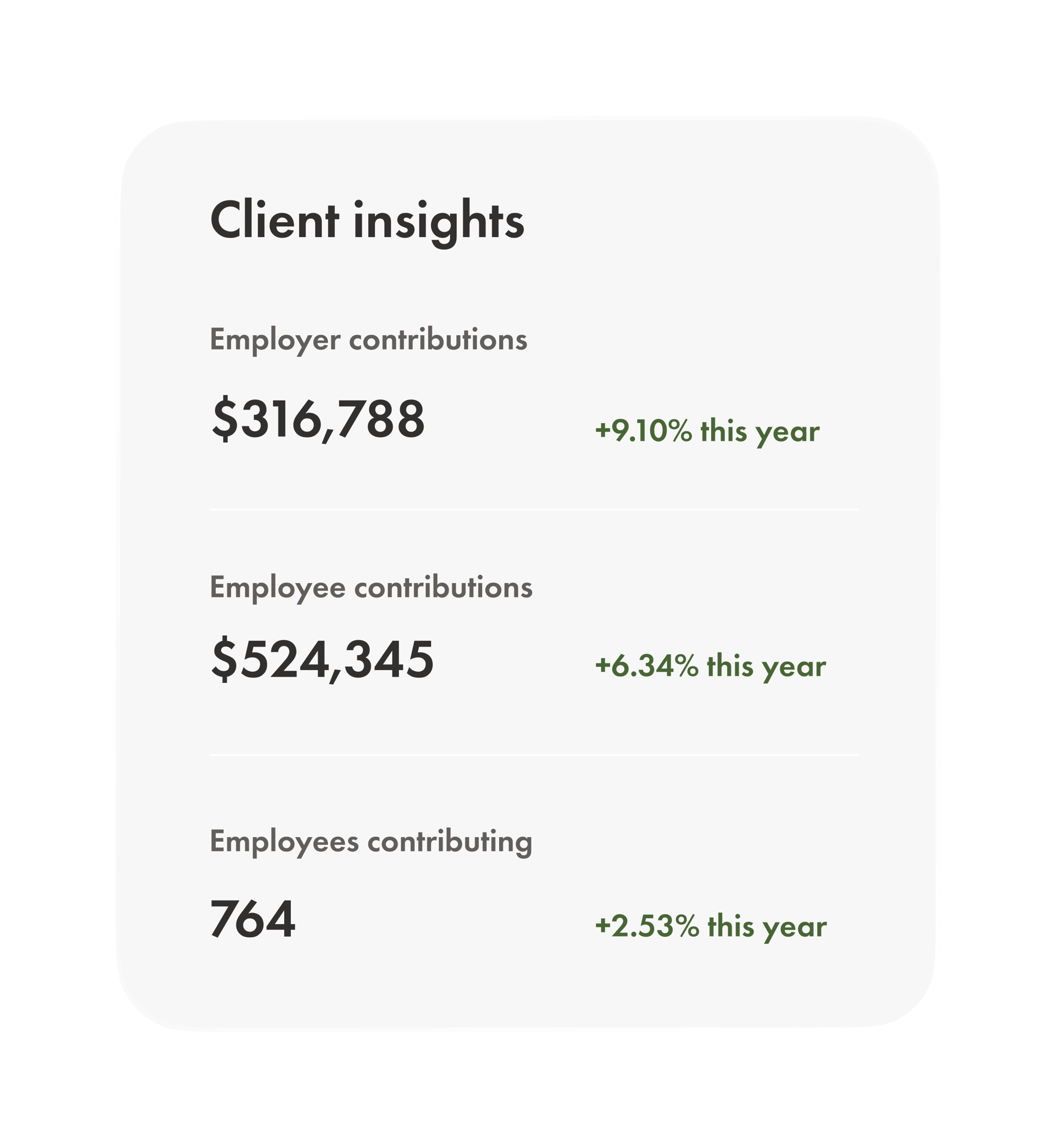

Numbers you can count on

At Wealthsimple, we’ve been helping shape the financial future of more than 3 million Canadians for over 10 years. And today, they trust us with more than $50 billion of their assets.

Tailored to your clients' needs

Unlike many of the big life insurance companies, we don’t overlook the smaller players. We work with employers of all sizes and are happy to work partner together.

Trusted by Canada’s best

We’ve helped some of Canada’s biggest employers, like Shopify and Dialogue, to move from a one-size-fits-all plan to a fully personalized savings solutions.

19 days

average new client onboarding time

80%

average matching plan adoption

67%

employee retention after 12 months

Helpful resources to have on hand

Our resource centre is your go-to for getting your questions answered, or for sharing more info with your clients on who we are and what we offer.

Group accounts that go beyond the GRRSP

We offer a range of group account types to suit whatever members are saving for.

Ready to put a new plan in motion?

Get in touch with our team to chat about how we can work together.

FAQs

What types of group savings plans do you offer?

What types of group savings plans do you offer?

We currently administer GRRSPs, GFHSAs, GTFSAs, DPSPs and Group non-registered accounts. These account type allows your clients to offer their team access to tax-efficient, employer-sponsored group savings.

Who uses Wealthsimple for Business?

Who uses Wealthsimple for Business?

We work with clients of all sizes and from a variety of industries. This includes employers just setting up a group savings plan for the first time, to organizations with an existing plan that they have transferred to Wealthsimple.

Can my client transfer their existing group plan to Wealthsimple?

Can my client transfer their existing group plan to Wealthsimple?

Yes, they can transfer their existing plan to Wealthsimple as long as we currently support that account type. We have a transfer team that will work with their current provider to make it a fast and painless experience. Transfer times depend on their current provider, but can take an average of 4 to 6 weeks.

In most cases, Wealthsimple will cover any transfer fees incurred from moving out of their existing provider. Talk to our team to find out more.

What fees do you charge for a group savings plan?

What fees do you charge for a group savings plan?

Employees pay 1% and lower for our selection of portfolios.

For a detailed breakdown of all portfolios and to see what rates employees might pay, get in touch with the team.

There are no hidden fees for transfers, withdrawals or account changes.

In fact, we'll cover the cost of any transfer fees involved in moving an existing plan to Wealthsimple.

What’s the onboarding process like?

What’s the onboarding process like?

Once sign off is done electronically, our team will ensure you and your client are comfortable with the platform and performing all key actions. This may include integrating other systems into Wealthsimple for easy and fast data transfer.

With all administrators up and running, we'll then invite the rest of your client's plan members to Wealthsimple where they can electronically set up their accounts.

Any members who are existing Wealthsimple clients will connect their existing account to their group savings plan.

Can plan members trade their own stocks?

Can plan members trade their own stocks?

Today, members who are interested in trading their own stocks using the savings they accumulate in a group savings plan will need to perform regular transfers in-kind to a self-directed trading account at Wealthsimple.

There is no tax impact of doing so, but it does require a manual action on the member’s part.