Get instant help from AI

Call 1-778-601-8337

Options

Get speed, control, and advanced strategies, all for $0. Start trading in minutes.

It’s true. We’re the first and only options trading platform in Canada with no commissions or contract fees — so you keep more of what’s yours.

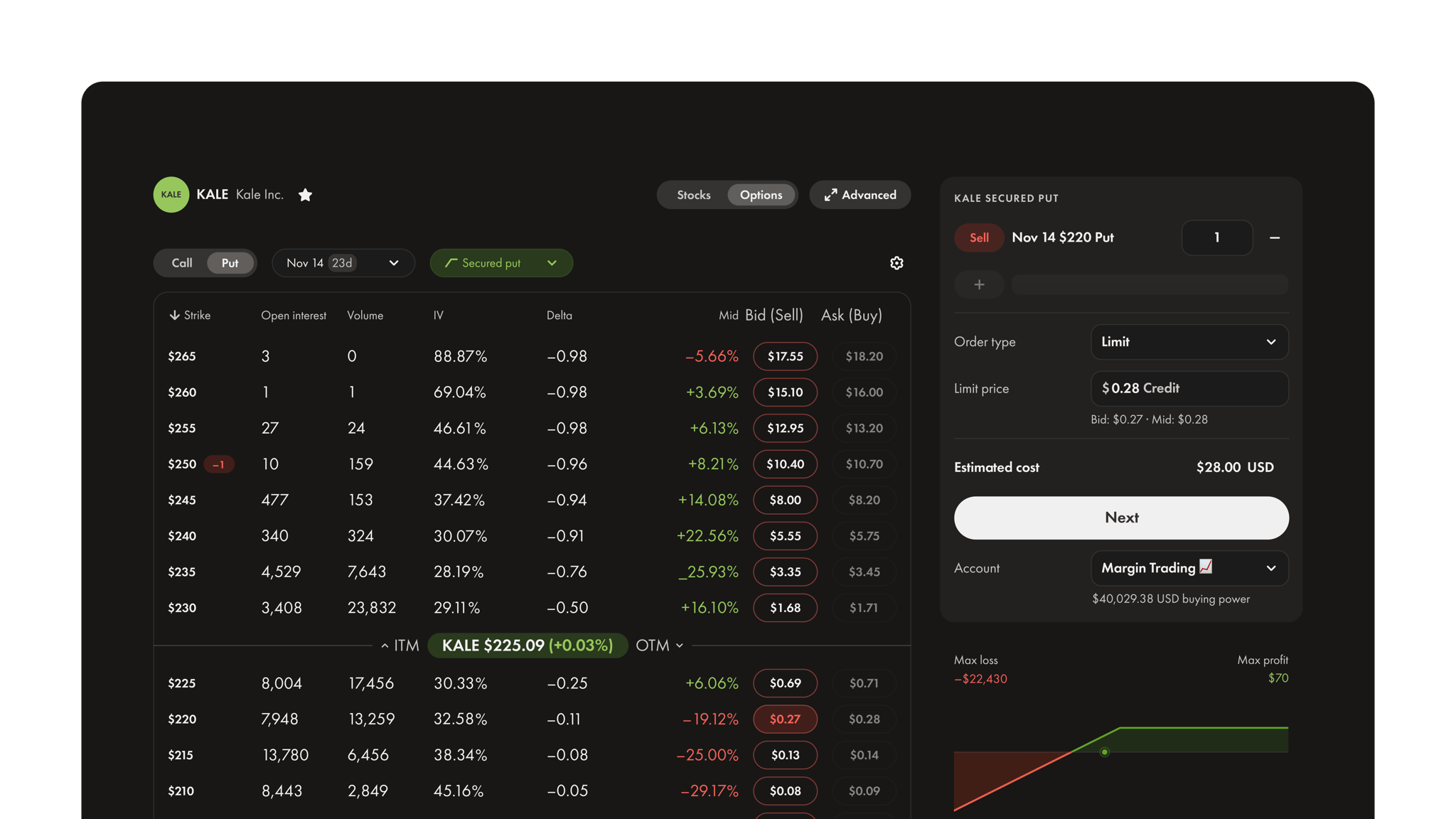

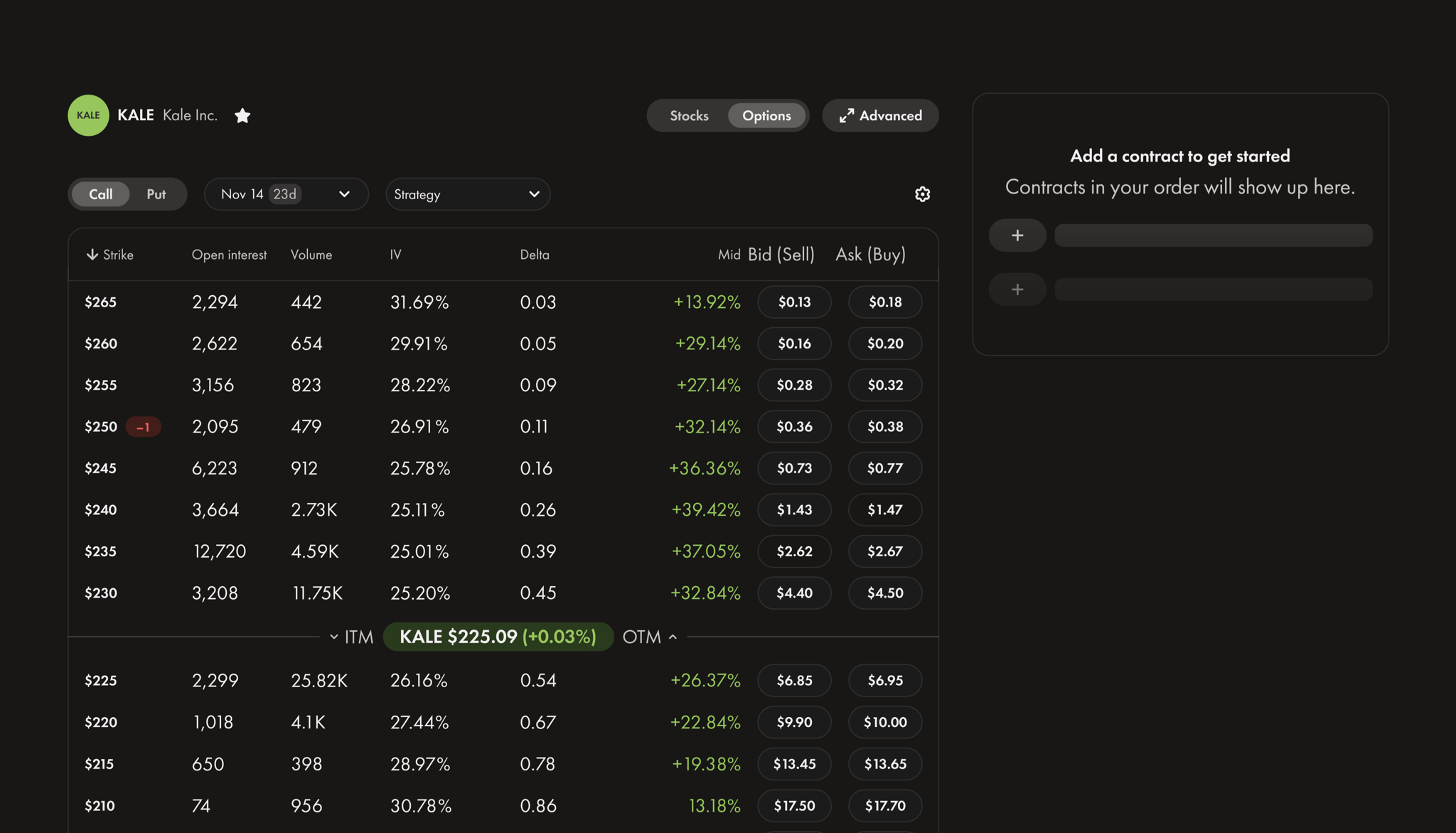

Take control of your market outlook with secured puts and multi-leg option strategies like vertical spreads, calendar spreads, and more.

Whether you trade on web or mobile (or both), our platform is designed to bring you more speed, insight, and control.

ENDS DECEMBER 23

Just register then transfer or deposit $100,000+ within 30 days. Terms and conditions apply.

Our platform’s built to react to market movements with agility so you don’t miss out on potential gains. Consider it your trading command centre.

Your options chain updates instantly with real-time market data. No more missed opportunities.

Stay on top of trades with rolling options, auto-sell, and order editing — all while reducing friction and errors.

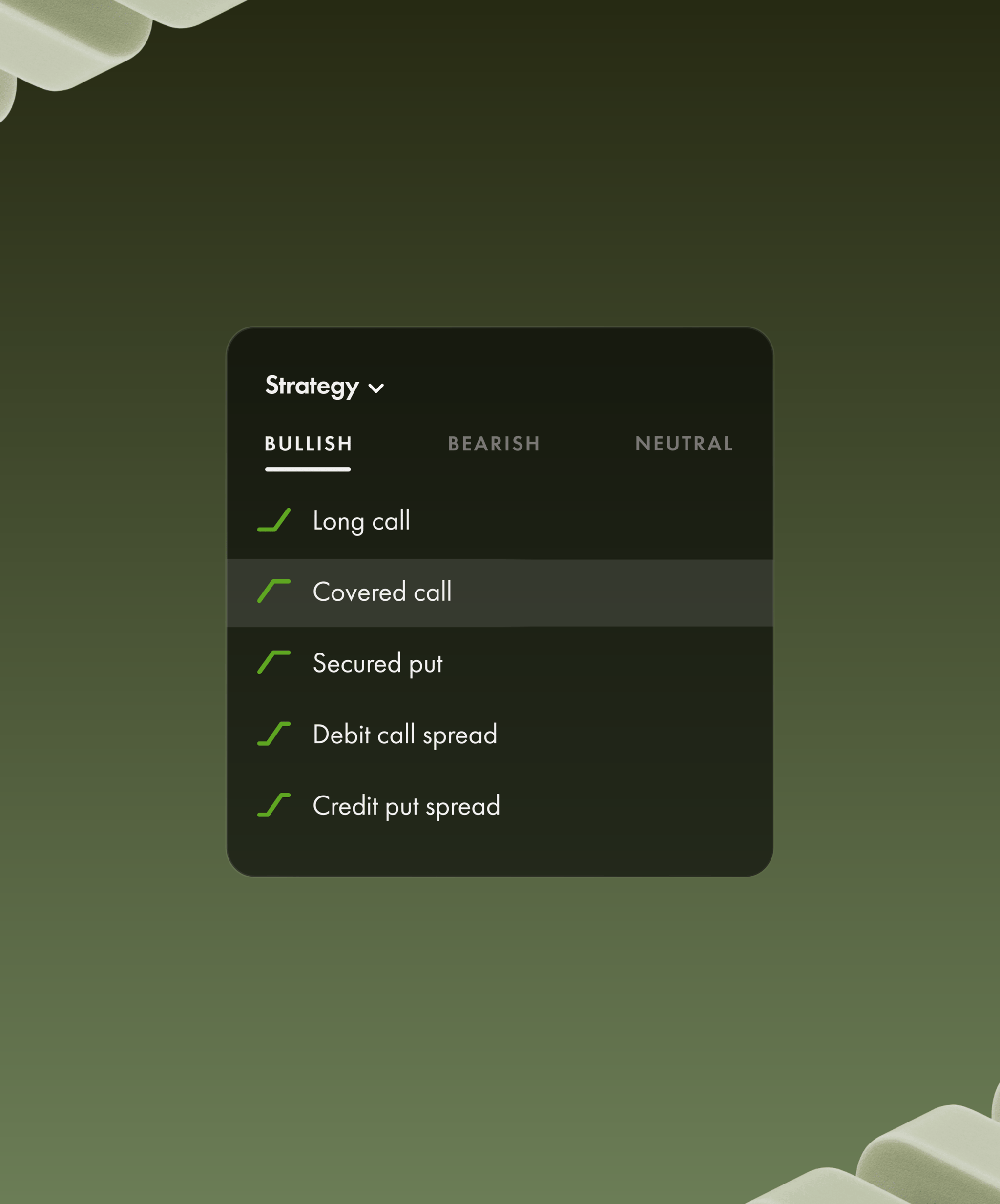

Coming soon: Pick pre-built strategies for bullish, bearish, or neutral outlooks. Then, visualize your profits, losses, or break-even points.

Execute your options strategy, no matter how simple or complex.

Wealthsimple | TD Bank | Questrade | IBKR | |

|---|---|---|---|---|

| Commission fees | $0 | $9.99 | $0 | $0 |

| Contract fees | $0 | $1.25 | $0.15—$0.99 | $0.25—$0.65 ($1 minimum) |

We support covered calls, secured puts, and multi-leg strategies (like vertical and calendar spreads). Learn more about our options trading strategies here.

Long calls, long puts, and covered calls are allowed in margin accounts or registered accounts (such as TFSA, RRSP, and more). All other strategies can only be placed in a margin account.

FYI: There are tax implications when trading from specific account types. Make sure you know those details before you start trading — learn more about enabling options in your investing account here.

We currently offer options trading on thousands of U.S. stocks and ETFs across the NYSE and NASDAQ exchanges.

Yes, you can trade all options on the mobile app and on desktop — whichever you prefer.

Good on you. It’s always a smart idea to do extra research on new investing strategies before diving in.

If you’re the learn-by-doing type, our app provides step-by-step education to help you understand calls, puts, strike prices, expiry dates, and more. That way, you can trade options with more confidence.

If you’re more of a reader, we’ve put together a helpful options trade resource that covers everything from key terms, how options trading works and risks involved.

You know it. There are no commission or contract trading fees to trade options with us. As of October 22nd, 2025, it’s the only $0 options trading platform in Canada, as compared with all Canadian order-executions-only investment dealers regulated by CIRO that offer options trading.

In some cases, there may be additional fees to consider, such as exercise fees or foreign exchange fees (if you don’t have a USD account). For more information, please see our Trade Fee Disclosure.