Everything you need to know to buy a home

Answers to the nine most important, confusing, or just plain scary questions you may have about home buying. Scroll down to get started.

(If you’re already an expert and would rather get a mortgage quote than all this advice, click below.)

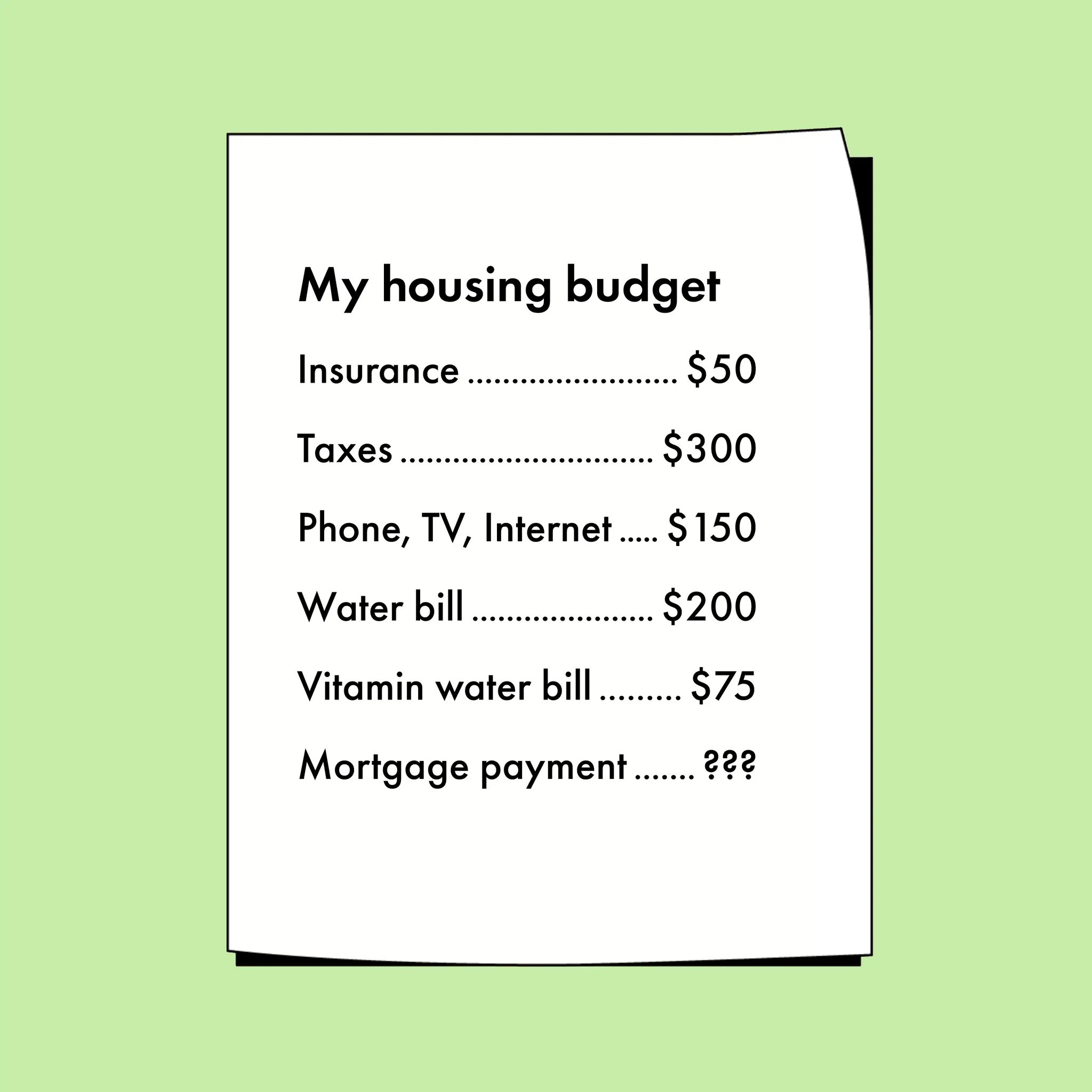

How do I figure out what I can afford?

The mortgage you’re approved for is not the same as the one you can comfortably pay. There are ways to set a budget that won’t have you reusing mouthwash.

Where can I get the most for my money (and actually want to live)?

A change in geography can often mean a change in lifestyle (or at least how many bathrooms you can afford). Here’s how different housing prices are in various Canadian cities.

What’s a good 3-step plan to save for a down payment?

1. Set the right target

The minimum requirement for a down payment is 5%, but that’s only if the home costs less than $500,000. If you can manage, you’ll want to save more than just the minimum. Getting to 20% can be tough, but reaching it comes with big perks — and some breathing room. Here's how.

2. Use those tax shelters

FHSA, TFSA, RRSP: the tax advantages of these three registered accounts can lead to thousands of dollars of savings. You get tax breaks when you make contributions or withdrawals — or, in the case of FHSAs, both. It’s smart to fill them up, but the order in which you do so can make a difference. Here's why.

3. Be cautious with your caution

Many people underestimate just how long it can take to save this kind of money. They play it safe by investing in cash and GICs. But that short-term focus can distract from long-term goals. Diversify, but with a few calculated risks. And invest regularly, no matter how jittery the markets might make you. Here's what that looks like.

How do I pick the right mortgage?

Learn moreFixed or variable?

When it helps (or doesn’t) to lock in a rate

Open or closed?

Why you would (or wouldn’t) pay off a mortgage early

Three-, five-, or ten-year term?

How your choice affects your payments

Does amortization matter?

Lower payments can come with drawbacks

Bonus wisdom!

When to shop around, and what fine print to look out for

What makes a good realtor (and how do I find one)?

Terms

What’s their commission? Is this relationship exclusive? For how long?

Specialty

If you’re looking for a cottage on 10 acres, you don’t want someone who’s only done high-rise condos.

Chemistry

Do you even like them? You’ll be spending lots of time together! Here's everything you need to know.

How do I make a winning bid (without wildly overpaying)?

Imagine closing your eyes and throwing a dart. Anybody can hit the wall. But getting close to the bull’s-eye (in this case, the lowest possible winning offer) comes down to doing your homework, having the right real estate agent, and laying on the charm.

What parts of closing should I not sleep through?

The good news: you’re this close to being a new homeowner! The bad news: you’re going to need to pay a few more fees before the ink dries. Here are the most important things to know — including why you should never close on a Friday.

What kind of maintenance costs should I plan for?

You own more than just your home now. You’re also the proud new owner of a roof that’ll need patching someday, windows that’ll need replacing, a septic system that’ll need unclogging…

Wait, I have to do this again in five years?

Yup. You’ll have to renew your mortgage again (and again, and again). But there are ways to be smart about it — and potentially save a boatload of money.

The mortgage that gives you money

Get a low rate through Pine and cash rebates from us. Because the more you have with Wealthsimple, the less you’ll spend on your mortgage payments.