Margin rates as low as 3.95%

Get access to increased buying power with margin accounts. Borrow against your portfolio with rates lower than your bank.

Unlock the power of margin trading

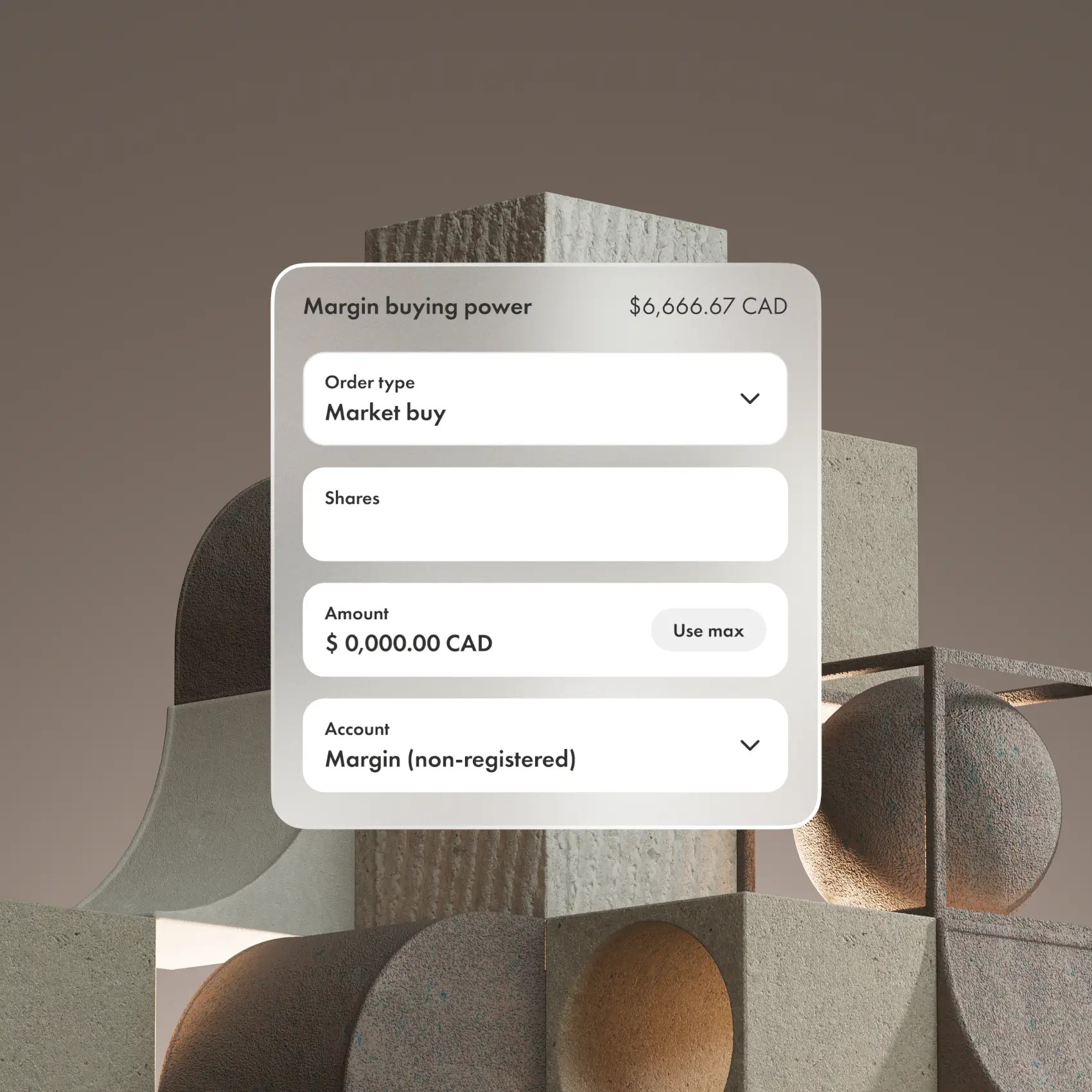

Boosted buying power

A margin account lets you borrow against your investments to unlock more purchasing power, so you can take advantage of market opportunities as they're happening.

Lower interest rates

Thanks to our competitive interest rates, margin borrowing is a smarter, more affordable way to access additional funds than many conventional lines of credit or loans.

Fast, flexible loans

Approved clients get fast access to additional cash that you can pay back on your own schedule and withdraw anytime, as long as your account is in good standing.

The (Un)real Deal

Get up to a 3% match and win a $3M home? Unreal.

Don’t miss out on our biggest promotion ever. Ends March 31. T&Cs apply.

Get lower rates as your wealth grows

Whether you’re buying in CAD or USD, our rates are lower than at any Canadian bank — and the more money you have here, the lower they get.

$1 in assets

4.95%

CAD margin rate

$100,000 in assets

4.45%

CAD margin rate

$500,000 in assets

3.95%

CAD margin rate

As of December 11, 2025, Wealthsimple's margin account prime rates are 4.45% for CAD and 6.75% for USD. Core clients pay prime +0.5%, Premium clients pay prime +0%, and Generation clients pay prime -0.5%. Rates may change, and interest is calculated daily and charged monthly.

The smarter choice for trading on margin

Rates that beat the big banks

We’ve compared the major Canadian banks’ margin rates to our Premium client rates for loans under $100,000.

Wealthsimple Premium | The green bank | The royal blue bank | The red bank | |

|---|---|---|---|---|

| CAD margin rate | 4.45% | 7.00% | 5.95% | 6.55% |

| USD margin rate | 6.75% | 9.00% | 8.75% | 9.10% |

How to: margin guide

Haven’t wrapped your head around margin yet?

We've got it all covered: margin calls, cash vs. margin accounts, and — to save you finding out the hard way — the seven worst ways to use it.

Build more wealth for bigger benefits

Learn the risks and rewards of margin trading

FAQs

What is a margin account? And how does it work, exactly?

What is a margin account? And how does it work, exactly?

A margin account is a type of investment account that allows you to borrow money from a brokerage (like Wealthsimple) to purchase investment assets (like stocks, options, etc). This increases your buying power, and allows you to invest more and potentially earn great returns.

When you want to make a purchase in a margin account, your existing cash will be used first. If the amount of your trade is more than the cash you have on hand, you can tap into borrowed money to increase your initial investment.

What are the benefits (and risks) of buying on margin?

What are the benefits (and risks) of buying on margin?

Benefits

-

Greater potential returns: Buying on margin increases your buying power, which could potentially increase your returns.

-

Flexibility: Buying on margin allows you to move quickly to take advantage of timely market opportunities that you might otherwise miss out on by not having enough cash or liquid assets.

-

Access to cash: With a margin account, you can withdraw funds against your assets as long as there is available margin to do so. This is similar to a secured line of credit, using your securities as collateral. This is often cheaper and provides quicker access to cash than other types of loans. Withdrawn money is not taxed and interest charged is tax-deductible.

Risks

-

Greater potential losses: Buying on margin can open up the potential to lose more money than your initial investment. The same leverage that magnifies your gains can also magnify your losses. If you buy a security and its price falls, not only will you lose your initial investment, you’ll also still need to repay what you borrowed — whether that’s dipping into other savings or investments, if you have them, or finding other means to repay the loan.

-

Cost of interest: As with any loan, the more you borrow, the more interest you’ll have to pay.

-

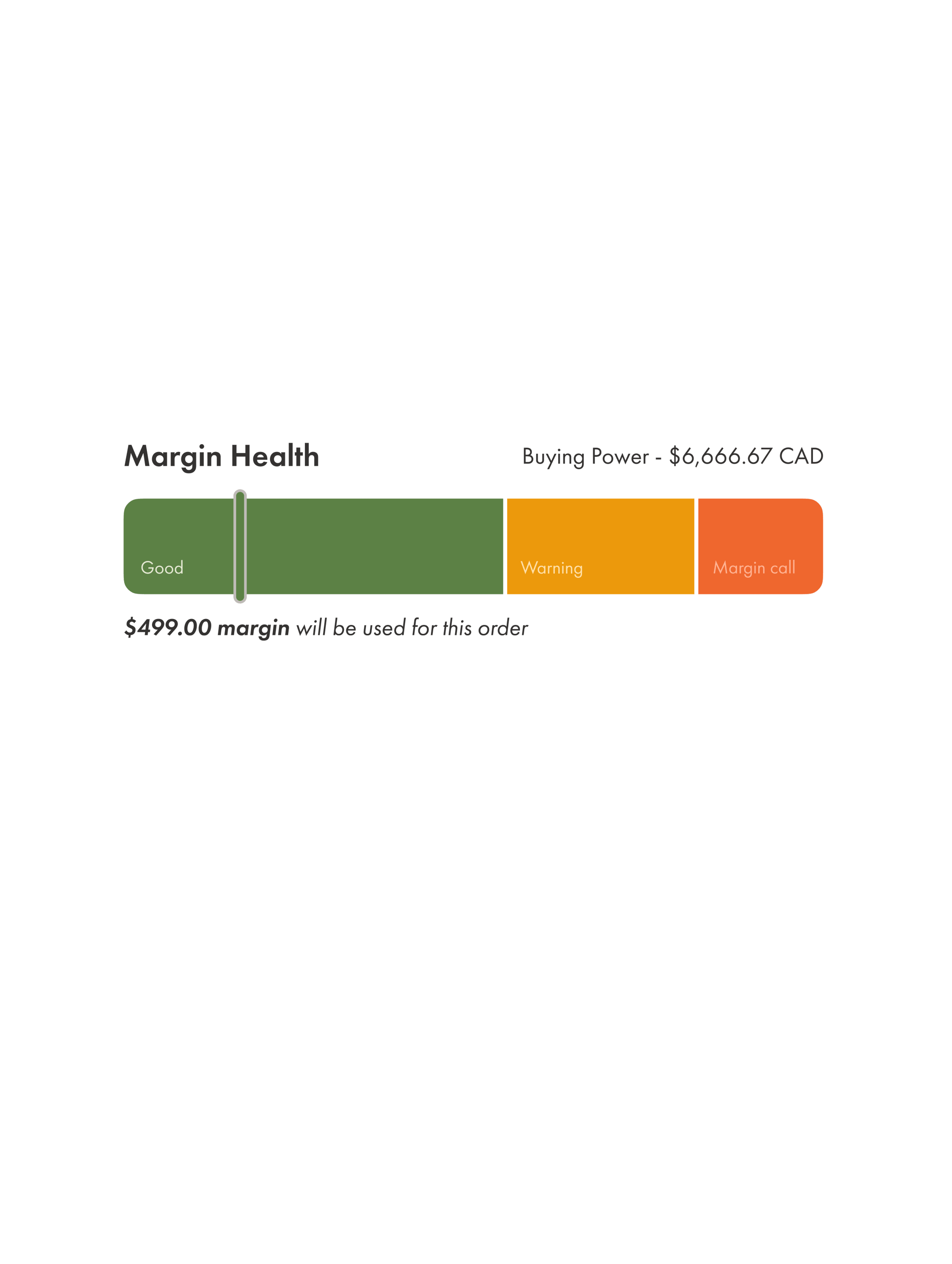

Margin calls: If your account falls beneath the maintenance margin, you’ll get a margin call, and will need add more cash or margin-eligible securities to your margin account (or sell some of your positions) to bring your buying power above zero. If you don’t, the brokerage can sell some or all of the securities in your accounts based on the agreements you signed when you opened your account.

How much can I leverage or borrow?

How much can I leverage or borrow?

Leverage on securities can vary since it is dependent on the type of security, and the price of the security itself. There are different margin requirements for different securities which are set by the Canadian Investment Regulatory Organization (CIRO). For example, If the stock has a margin requirement of 30% then you can leverage up to 3.33x of your Margin available balance.

Brokerages (like Wealthsimple) can set their own margin requirements, as long as they’re higher than the minimums established by CIRO. They might also set an overall limit on how much you can borrow or a limit for how much you can borrow on a single security, which is known as a concentration limit. These limits may be based on your financial situation, portfolio, or firm policy limits.

How is interest charged on margin accounts?

How is interest charged on margin accounts?

When borrowing money from Wealthsimple in your margin account, you’ll be charged an interest rate based on the current CAD or USD prime and your client status. Currently, Wealthsimple charges the following based on your client status:

- Core - CAD/USD prime +0.5%

- Premium - CAD/USD prime +0%

- Generation - CAD/USD prime -0.5%

Interest is accrued daily and deducted from your margin account on a monthly basis.

What assets or strategies am I currently able to trade on margin?

What assets or strategies am I currently able to trade on margin?

Currently, clients can trade the following within their margin accounts:

-

CAD/USD stocks

-

CAD/USD ETFS

-

Long calls

-

Long puts

-

Covered calls

Options strategies are only available for U.S. assets. Stay tuned as we're actively working on bringing more trading strategies to our margin offering.

How do I open a margin account?

How do I open a margin account?

You can open a margin account on the mobile app or on web.

Since there’s higher risk associated with margin trading, you’ll need to apply for your account. We’ll ask some quick questions about your employment, financial status, and a few other things. Once you’re approved, fund your account by providing cash or eligible securities as collateral. After that, your account is ready to go!

For step by step instructions, please visit this helpful article.

Wait, are the rates really lower than all Canadian banks?

Wait, are the rates really lower than all Canadian banks?

Yes, As of December 11, 2025. We compared our rates with all margin interest rates with similar asset requirements available from Canadian financial institution listed under Schedule I under the Bank Act.

Will linking my TFSA to my margin account affect my TFSA contribution room?

Will linking my TFSA to my margin account affect my TFSA contribution room?

Nope. Linking your TFSA is not considered a withdrawal or a contribution, so it won’t impact your TFSA contribution room. Your assets stay in your TFSA.

You can learn more about linking your TFSA to your margin account here.