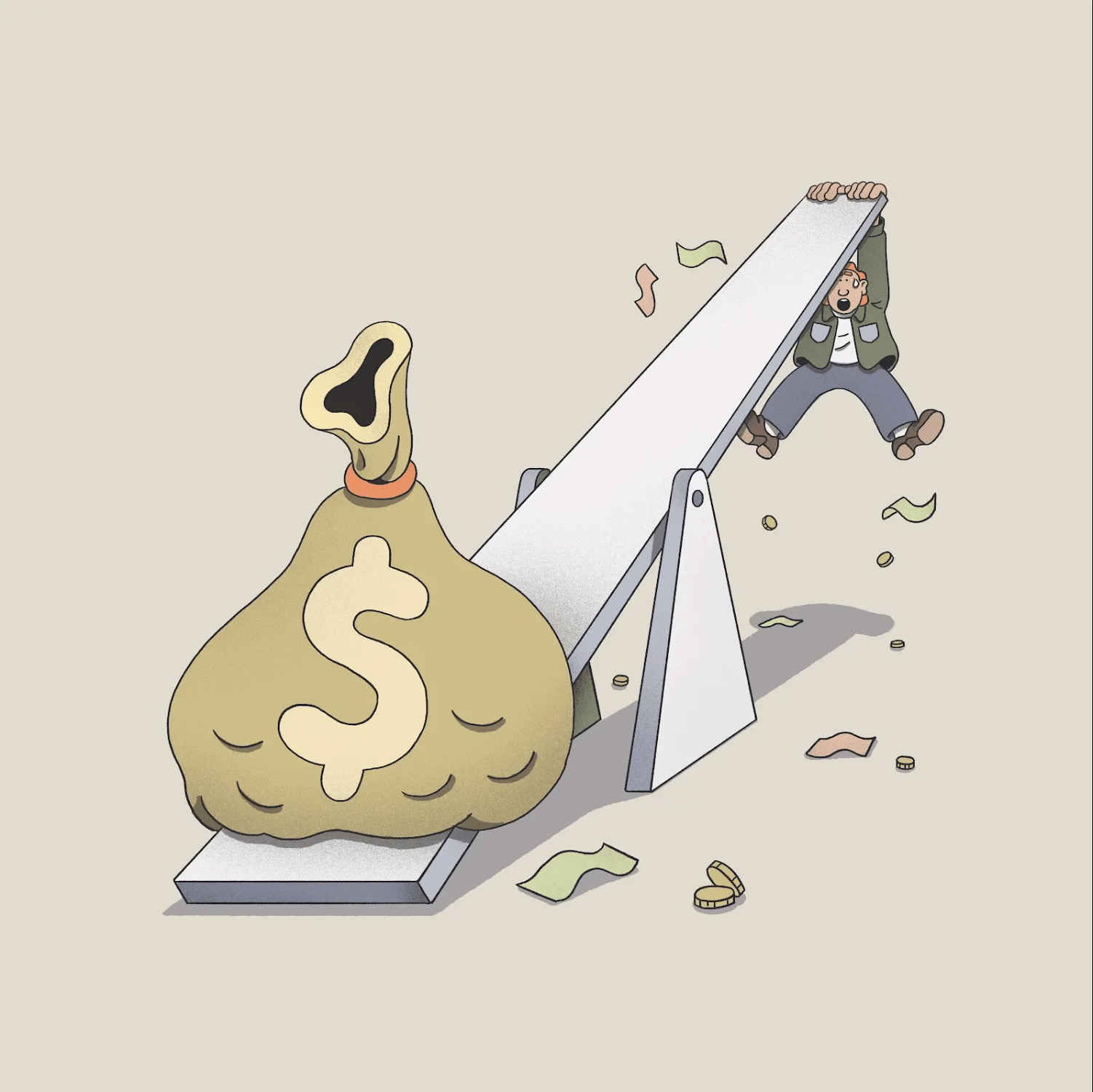

Trading on margin allows you to buy stocks with a little bit of your own money and a lot of someone else’s. When you profit, those profits are amplified, because you’re making money off of your money and the money you borrowed. But when you lose money, those losses are amplified too.

For an example of the towering heights and plunging depths that can be experienced trading on margin, just take a look at the tale of the investor who built up a $415 million portfolio and lost it all in the span of three years.

In order to help you avoid a similar fate, here is a list of the most common mistakes margin traders make. Avoid them, and you have a much higher chance of enjoying the margin roller coaster. Or at least not throwing up.

Mistake #1: Not understanding how margin trading works

This one may seem obvious, but it’s worth including. A lot of people see the chance to boost profits and dive in without completely understanding what they’re doing. But that’s not you, because you’re here, reading about mistakes not to make.

Mistake #2: Not managing your risk

Margin lets you deploy capital more efficiently than traditional investing. You can use leverage to invest more than $100 for every $100 you have in your account — but in what are possibly the words of Voltaire (and what are definitely the words of Uncle Ben in “Spider-Man”): with great power comes great responsibility. Not only do you need to be aware of how you’re allocating your money, you also need to pay attention to how you’re allocating risk. That’s good advice for all investors, but especially for margin investors, since you can much more easily erase your wealth.

Mistake #3: Taking on too much risk

Some stocks and leveraged exchange-traded funds are already very volatile. When you trade them on margin, you’re cranking up that volatility. Let’s say there’s a stock, $LOON, that has a volatility of 60%. That means it’s not unusual for its price to jump or fall by nearly two-thirds at any given time. You’re already in high-risk, high-reward territory simply by investing. Adding margin to the mix may not be the wisest move.

Mistake #4: Forgetting that volatility can change

Just like its price, a stock’s volatility can change at any time. Since the amount of money you can borrow in a margin account is based on the volatility of the stock you’re buying, a sudden change in volatility would mean a sudden change in capital requirements — not to mention a change in the riskiness of your portfolio. If you don’t have a cushion in your account, you’ll need to deposit more cash or other assets when this happens. Otherwise you could be on the receiving end of a margin call. That may involve your broker liquidating your position to make sure they get their money, forcing you to realize losses you may not have been prepared for.

Mistake #5: Thinking asset prices will always go up

Markets have periods where they get hot. It’s easy to get caught up in that kind of success and convince yourself to keep rolling any profits you make into more margin bets. But don’t let the excitement fog your memory: the good times don’t last forever. Bull markets always go bear-shaped. If you’re investing like that’s never going to happen, your wake-up call will be very expensive.

Mistake #6: Getting too speculative or emotional about your trades

In any kind of investing, you want to have a strategy and stick to it. That’s especially true of margin, when even more is on the line. Greed or fear can push you to make rash decisions, and the potential negative impact of those decisions is amplified just as much as your returns could be. Be deliberate with what you’re investing in. Get out when you plan to get out, and don’t throw good money after bad.

Mistake #7: Investing in low-returning assets

This is a big one that a lot of people overlook: you’re charged interest on the money you borrow on margin, which means you need your investment to outperform that interest rate. Typically, you don’t want to leverage an investment in something with an expected return of 5% when you’re paying 7% to do it. You can actually make less than you would have had you not used margin at all.