Welcome to the nail-biting phase of shopping for your new home. You’re about to start throwing around sums of money that feel preposterous to say out loud — and adding thousands of dollars to offers like you’re talking about pennies.

The rules of engagement vary by city and province, but what they all have in common is a near total lack of visibility into what kind of offers the seller has in front of them. You won’t really know anything, and they don’t have to tell you.

This is the phase where an expert real estate agent becomes indispensable. “They will be the ones to really dig in, get into the situation, and ascertain what’s happening,” says Khalid Ebrahim, veteran real estate agent and principal broker with Pine Financial (the Toronto-based company Wealthsimple recently partnered with to offer mortgages). You’ll want to work with them to determine the right offer to make, based on the current state of the market. And while the highest number usually wins, since you won’t ever know what the competition is offering (even if you do get the place), there are a few negotiation tactics you can take to up your chances. Here are some of the more common ones.

How to negotiate on a house

Escalation clause: If you’re the only bidder on a property, the negotiations tend to be straightforward: you haggle back and forth, and you either agree on a price or you don’t. But if there are multiple bidders, game theory kicks in. One tool at your disposal is an escalation clause, which is when you make an opening bid but you inform the seller that if there’s a higher bid out there, you’ll keep adding to yours all the way up to a best-and-final number. You might say, for instance, that your opening offer is $500,000, but if someone else offers more, you’re willing to beat it by another $5,000, all the way up to $600,000.

The risk here, though, Ebrahim says, is that you’re showing your cards. The seller’s agent’s fiduciary duty is to their client, not you, so maybe they’ll just take your offer, shop it around, get another offer for $595,000, and — with the knowledge of what your ceiling is — take you straight up to six. So then what’s the point of an escalation clause? Why do it at all? Because a rival bidder, or bidders, might opt for one. In which case you might never get to make your best offer, and you lose your dream house to them.

Commission discount: This is when the buyer’s agent agrees to reduce their fee in order to help their client land the property. They’ll get less money out of the deal, but less money is better than no money. Remember, the seller pays the commission on the deal, and your agent gets paid out from that money, so if another buyer’s agent agrees to take less, the seller pays less. In some jurisdictions, a commission discount has to be disclosed. If you run up against an offer that includes a discounted commission from your rival, your agent has the option to cut their fee as well, or you can increase your offer to make up the difference.

Irrevocable period: This refers to the amount of time a prospective buyer’s offer is on the table. If the seller doesn’t accept it within that period, the offer expires. Let’s go back to that $500,000 opening offer you made with the knowledge that you’d be willing to go up to $600,000. If a rival bidder comes in with an offer of $575,000 that expires in 24 hours, the seller might just take it without giving you the opportunity to beat it.

Bully offer: This is an irrevocable period, but turned up a few dozen notches: your offer expires in a big hurry. Take it or leave it. You see the property in the morning, make an offer at noon, and give the seller two hours to accept it. Heck, you could give them 30 minutes. That’s a bully offer, and if it’s sweet enough, the seller might just blink and take it.

Presale visits: This one may seem a little fastidious, but standard offers include one to three presale visits. That could mean anything from a walkthrough with your contractor to a tour with your mother-in-law. If the house is currently occupied, the more visits you ask for, the more annoying your offer becomes.

Time-to-close: This term refers to the amount of time between having your offer accepted and actually handing over the check (and getting your keys). Thirty to 60 days is standard, but in some cases, a seller might want more time (as they find their own new place) or less (they’ve already bought that place and are floating two mortgages).

Offer conditions: Most offers on a home come with standard conditions. The most common is a financing condition, in which your offer is subject to your obtaining the necessary financing and a time period to secure it from a lender. If you don’t get the financing, the deal dies, and the seller has to start from scratch. If another bidder comes in with a cash offer and no financing condition, the seller will likely just take the certainty of cash in hand rather than risk your financing falling through — even if your offer is higher.

Another common condition is a home inspection, which is when you hire a licensed inspector to comb through the property and make sure every toilet flushes, every drain drains, and turning on the lights in the kitchen won’t start a fire in the basement. But a rival bidder may be willing to risk it, waiving the home inspection and removing any potential costly headaches for the seller. Most real estate agents advise against this practice, but that bid is probably going to beat yours.

One more common condition is a period of time to sell your current property. Let’s say you ask for 30 days. Another bidder might make a lower offer, but they’re ready to close right now. If the seller is in a hurry, or they just don’t want to take the risk that you run into problems selling your current home, you lose.

According to Ebrahim, conditions often trump price. The more you strip out, the more likely you are to win this bidding war. Fewer conditions from the buyer increases certainty for the seller, and sometimes certainty is more valuable than a few extra thousand dollars.

Want an example? Let’s say there’s two offers on a property. You’re at $950,000, the other bid is $1 million. As Ebrahim explains it: “You might say, ‘You know what? I can’t come up to a million, but I’m just going to remove all my conditions. My offer is guaranteed the second you sign off, and you’re going to get cash in hand as soon as we close.’” Now you win, and the higher offer loses. Just remember, those conditions are safety nets. Remove them and you’re on your own — no matter the eventual price tag.

Committed deposit: A serious buyer typically provides a security deposit within 24 hours of making an accepted offer. The bigger the committed deposit (5% is not unheard of), the more seriously the buyer is taken. When the outstanding closing conditions are met or removed, this deposit becomes part of the buyer’s down payment.

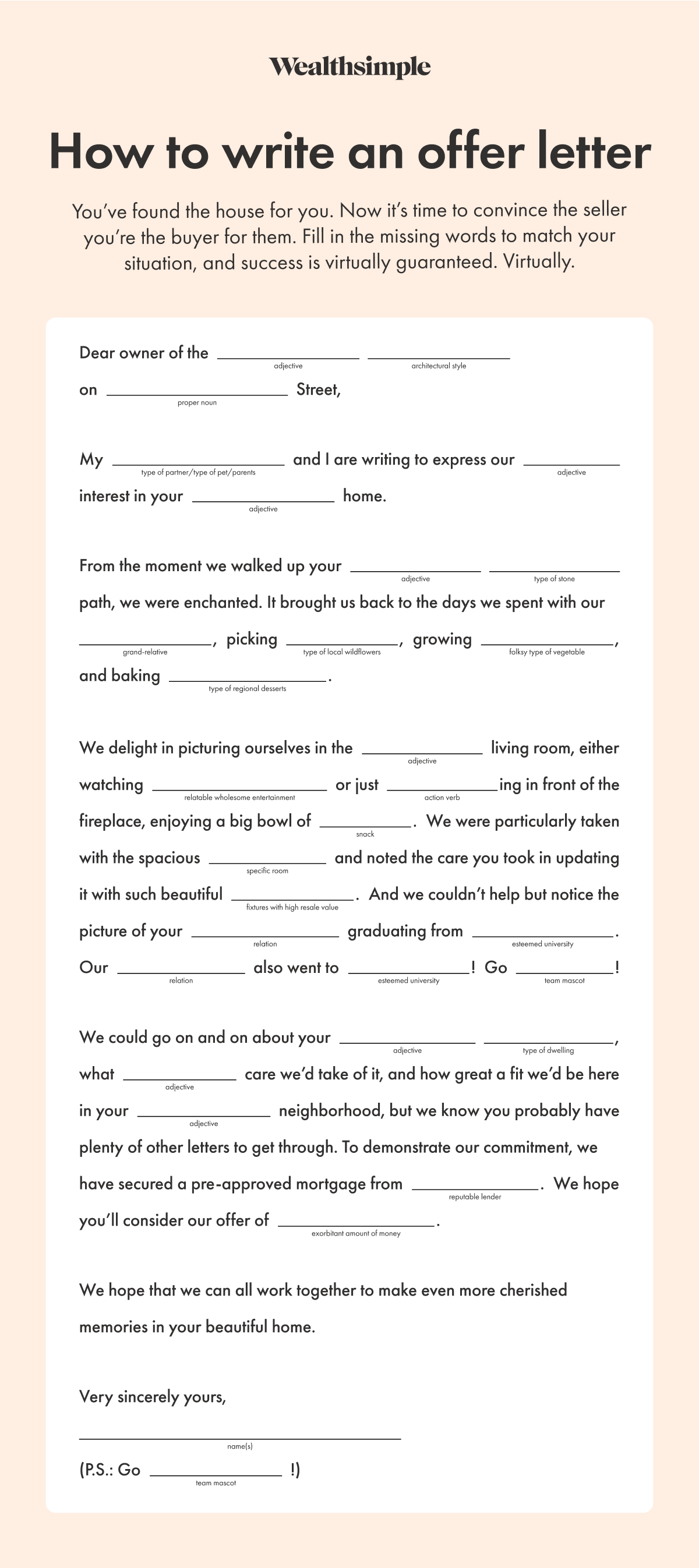

How to write a good offer letter

There are plenty of stories out there of letters that have tugged the right heartstrings of sellers, making one offer stand out from dozens of others. Their effectiveness is debatable. Ebrahim, for instance, says these letters have the potential to backfire. They could come off as cloying or manipulative, or your emotional tribute could inadvertently include details that turn off the sellers (maybe you mention that you make charcuterie for a living and the seller is a vegan, who can’t stand the idea of murdered meat in their home). But many buyers swear by the personal note. If you’re among them, here’s a handy template to get you started.