Personal finance doesn’t always have to be personal. Sometimes it’s shared. Like in a joint account.

If you’re splitting expenses or working toward a mutual savings goal, a joint bank account with a partner, friend, or family member might make sense for you. Here’s what you need to know about them — what they offer, who can use them, and their advantages and disadvantages.

What is a joint account (and how is it different from a regular account)?

As you can probably decipher from the name, a joint account is a chequing or savings account that is held jointly, which just means it’s shared with one or more people.

Joint bank account holders can do things like make deposits and withdrawals, send e-transfers and pay bills, and write cheques and transfer funds — basically, everything that a single account holder can do.

But with all those shared rights comes shared responsibility. If one account holder overdraws the account, for example, the resulting fees are the responsibility of both parties.

Who can open a joint account?

Joint bank accounts aren’t only for couples who want to combine finances. Roommates could open a joint account to pay for shared living costs. Co-founders might need multiple joint accounts to manage business expenses and save for future expenditures. Parents often open joint accounts with children to help manage their savings and give them access to spending money (after their rooms are clean, of course).

Advantages of a joint account

Paying for shared expenses is simpler. There’s no need to transfer your half of the rent or dinner bill when it’s all coming out of one account.

Streamlines saving for common goals. By saving up for a vacation or new furniture in a shared account, you can watch together as your individual deposits join forces and get you to your target faster.

Greater visibility. There’s nowhere to hide in a joint account. That transparency and visibility can boost accountability when it comes to spending and saving. It can also make it easier to create and follow budgets and other financial plans.

Risks of a joint account

What’s yours is theirs. Both account holders are on the hook for debts and fees incurred by the account, even if one person is to blame. In the case of a serious financial or legal situation, that means shared funds in the account could be seized.

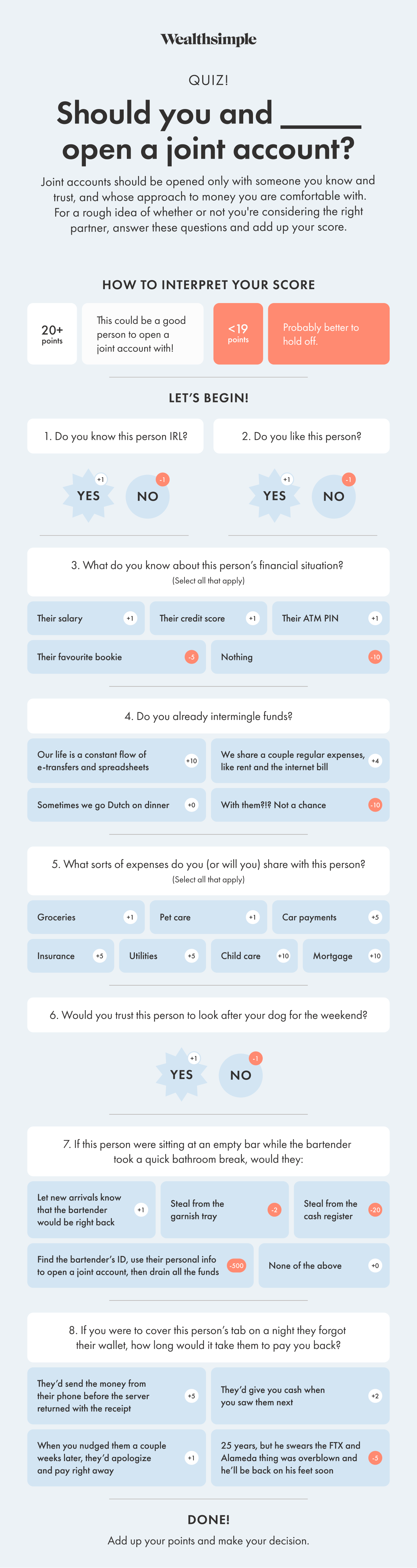

A lack of control. Although there are exceptions, with many joint accounts, one account holder can’t control the actions of another. Each person can withdraw however much they want, whenever they want, without penalty. That’s why you should only open a joint account with someone you really trust. (For help determining if you’re about to open an account with the right person, check out the quiz below.)

Greater visibility. Like we said before, there’s nowhere to hide in a joint account. If one of you isn’t contributing equally — or suddenly decided to pay for stand-up paddleboarding lessons from your emergency fund — you’re probably in store for some arguments.

Should you use a single account or a joint account?

Whether a single account or a joint account is the best fit for you depends on how you plan to use the account, as well as your individual habits and preferences.

Remember: these two accounts are not mutually exclusive. You can — and sometimes should — have both a single account and a joint account.

When a single account makes sense:

You want to maintain a sense of financial autonomy.

You don’t want someone else to have a full view of your transactions.

You have personal savings goals.

The other person has significant debt that you could be liable for.

When a joint account makes sense:

You have many regular shared expenses and bills.

You need transparency in order to create and manage a joint budget.

You’re saving as a team for a shared purchase.

You want to build a household emergency fund.

You want an oblivious friend to help pay for your stand-up paddleboarding lessons.

Bonus Quiz! Is this the right person to open a joint account with?